In the realm of open blockchain protocols, Uniswap stands select as a significant player due to its remarkable solution to the liquidity and decentralized finance (DeFi) problems within the blockchain. Through a unique protocol, it enables the smooth functioning of automated transactions between cryptocurrency tokens on the Ethereum blockchain.

Exploring Uniswap’s Core Fundamentals

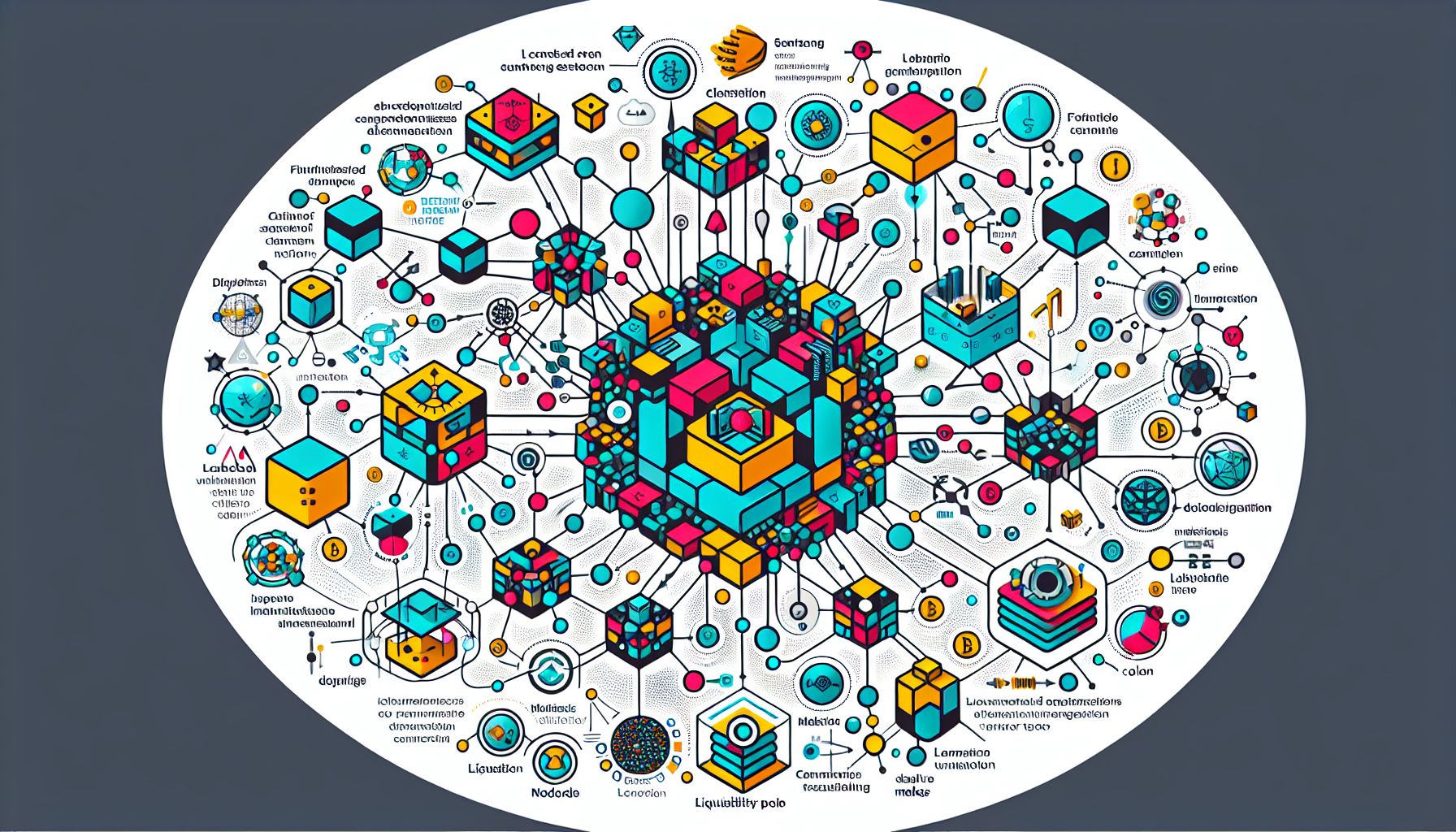

At its heart, Uniswap operates as an automated liquidity protocol built upon the Ethereum blockchain. It facilitates automated transactions between cryptocurrency tokens through liquidity pools, which are powered by smart contracts. By eliminating the need for the middlemen found in traditional financial institutions, Uniswap pioneers a high level of decentralization in finance.

Uniswap utilizes a model called the Constant Product Market Maker, which dictates the operation of its pools. Unlike the traditional exchange model of buyers and sellers deciding asset prices, in Uniswap, prices are determined using a mathematical formula. This formula depends on how much of each token exists in its reserves.

Understanding the Significance

Uniswap has transformed the way transactions take place in the DeFi space. Before Uniswap, transactions depended largely on order books in exchanges where the buyer and seller’s decision largely governed the price. Uniswap brought about a paradigm shift in this sector by introducing liquidity pools that democratize and decentralize transactions.

Users reap considerable benefits from Uniswap due to its permissionless function, allowing anyone to swap tokens, add tokens to a pool, and create a new pool. Given the open-source nature of the platform, user participation plays a pivotal role in strengthening the ecosystem. Moreover, developers enjoy access to the same liquidity pools as public traders, thereby achieving a unified infrastructure.

De-risking with Uniswap

Uniswap does not escape the volatility and risk associated with cryptocurrencies. However, it alleviates these issues substantially through its unique mechanism. One doesn’t need to trust anyone else. As all transactions are automated via smart contracts, the seller maintains control over their assets at all times unless trade is carried out. Moreover, Uniswap greatly mitigates counterparty risk by taking over the responsibility of fulfilling both sides of a trade themselves.

Conclusion: Unswerving Promise

Uniswap is reinventing the wheel of finance by removing traditional intermediaries and harnessing the power of blockchain to create a decentralized, democratized, and secure ecosystem – a significant stride forward in the DeFi landscape. As it continues to pioneer innovations, only time will reveal the full extent of its potential. However, it is evident that Uniswap’s unique and effective approach reflects a promising future for DeFi, propelling its relevance in the world of future finance.